- #Hurricane harvey fracked oil cracked

- #Hurricane harvey fracked oil full

But how true are those claims? Then we discuss the concept of sportswashing.

On Thursday's show: Politicians are pointing fingers at different entities about concerns regarding energy supply. That’s not expected to slow down the growth in Texas oil production, Clarke says, but it could make the whole equation more expensive. “And that's to be expected."Ĭlarke says if this trend continues, with fracked wells delivering less than expected as they get older, companies will have to drill even more new wells to make up for the loss. "The Permian is a tough basin, and as it matures, there are more and more challenges that are emerging,” says the firm’s Robert Clarke, a co-author on the new report. Now, research firm Wood Mackenzie says it's found that production from some West Texas wells is declining faster than drillers might realize. So, companies don't know a lot about how fracked wells are going to perform over the course of decades, like they do with older wells. In the grand scheme of oil history, the fracking revolution is still pretty young. That's the takeaway from a new report that says the problem could lead to higher costs for the industry in the years ahead. They might be, but in the meantime, consumers driving gasoline powered cars probably aren't going to face dramatic price hikes for fuel.West Texas oil drillers might be over-estimating how long their wells are going to last. Today, the prevailing wisdom on Wall Street holds that oil isn't the future, that electric cars are. Then the fracking revolution came along, increasing supplies and forcing the Saudis into an oil price war in the vain hope of driving the frackers out of business. There was a theory that the world was approaching peak oil production, with declining supplies - and higher prices - for the foreseeable future. Then, global economic growth was used to justify climbing oil prices. For one thing, AAA reports there are ample stockpiles of gasoline, so the market should be able to handle a short-term supply interruption.įor another, market speculators may not play the oil game like they did after 2005. entered the Great Recession, gasoline prices topped out at a national average $3.25 for the year.įortunately for consumers, very few expect anything like that to happen this time. Gasoline prices rose each year, not because of interruptions in supply but because the world economy, led by China and India, was said to be heating up. when new fracking and horizontal drilling methods prove to recover oil from shale.

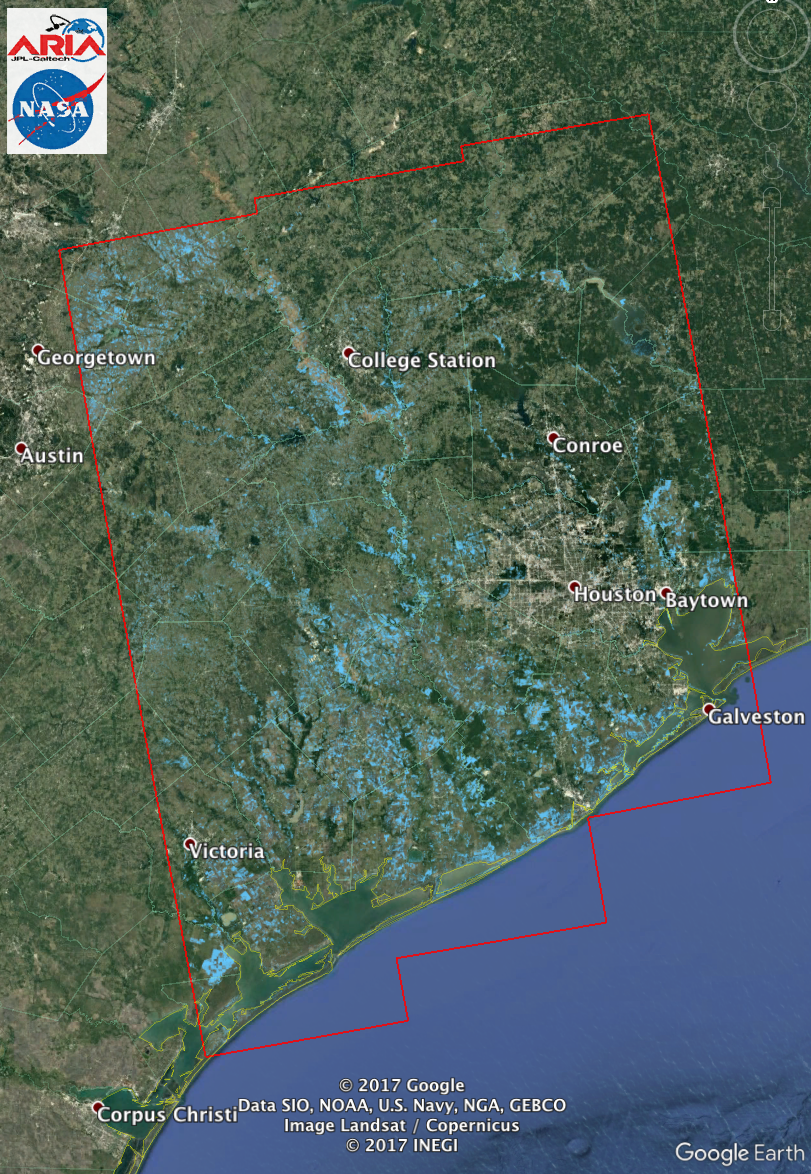

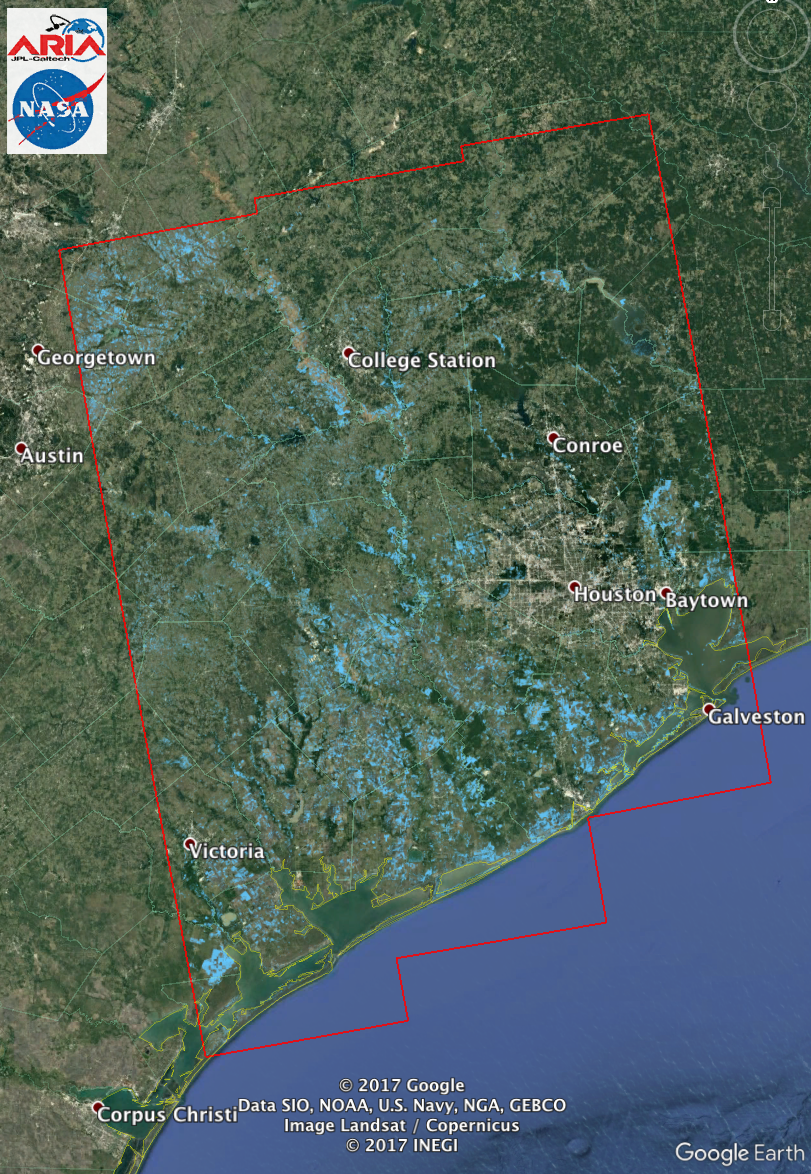

Oil prices rose worldwide as at least a dozen Texas refineries halted their. Daily high-resolution satellite imagery shows the rapid uptick in oil. Fracked oil and gas from around the country are piped to the region for processing, and the products are then exported around the world.

#Hurricane harvey fracked oil full

As we reported at the time, New Jersey inspectors visited 400 gas stations and wrote up 100 of them for violating state gasoline price regulations.Īt the time, New Jersey Consumer Affairs director Kimberly Ricketts said she, along with the state's motorists, expected gasoline prices to fall once the Gulf refineries resumed full production. Generally, the region produces 4.5 million barrels of refined petroleum products per day25 percent of the nation’s total.

#Hurricane harvey fracked oil cracked

But after Katrina and Rita, it shot up to $2.27.Īll over the country, states cracked down on alleged price-gouging. generate copious amount of oil and could be produced cheaply with the aid of fracking. In 2003, the national average gas price was $1.56 a gallon. oil industry is under pressure amid Hurricane Harvey. In the years before the storms, retail gasoline prices were steadily rising. It was a very different story in 2005, however, after two devastating hurricanes badly damaged the Gulf's oil and gasoline production capability. Kyle Cooper, director of research with IAF Advisors in Houston, explained to Bloomberg that the extremely heavy rainfall will also drastically reduce demand, at least temporarily, so the two will balance out. The market, in fact, doesn't seem to be too concerned that the massive amounts of rainfall threaten to flood Texas refineries. Despite the threat to oil production and refining capacity, oil prices went down Thursday.īloomberg News reported a 2.6% one-day drop in crude prices, mainly because only a few oil platforms had shut down in advance of the storm. Will history repeat itself? Industry analysts - and the oil market itself - are saying probably not. Consumers with long memories may recall that gasoline prices surged in the aftermath. The storm comes a dozen years after Katrina, then Rita, slammed the region, damaging oil rigs in the Gulf and refineries along the shore. Photo (c) gustavofrazao - FotoliaHurricane Harvey is plowing through the Gulf of Mexico oil fields and heading toward the Texas coast.

0 kommentar(er)

0 kommentar(er)